The Global Picture: A Year Defined by Escalation

The year 2025 will be remembered as the point when online scams stopped being an annoyance and became a global economic threat. Fraudsters across the world adopted artificial intelligence, automation, and deepfake technologies at a speed that overwhelmed consumers, businesses, and even cybersecurity agencies. The result: the highest scam-related losses ever recorded.

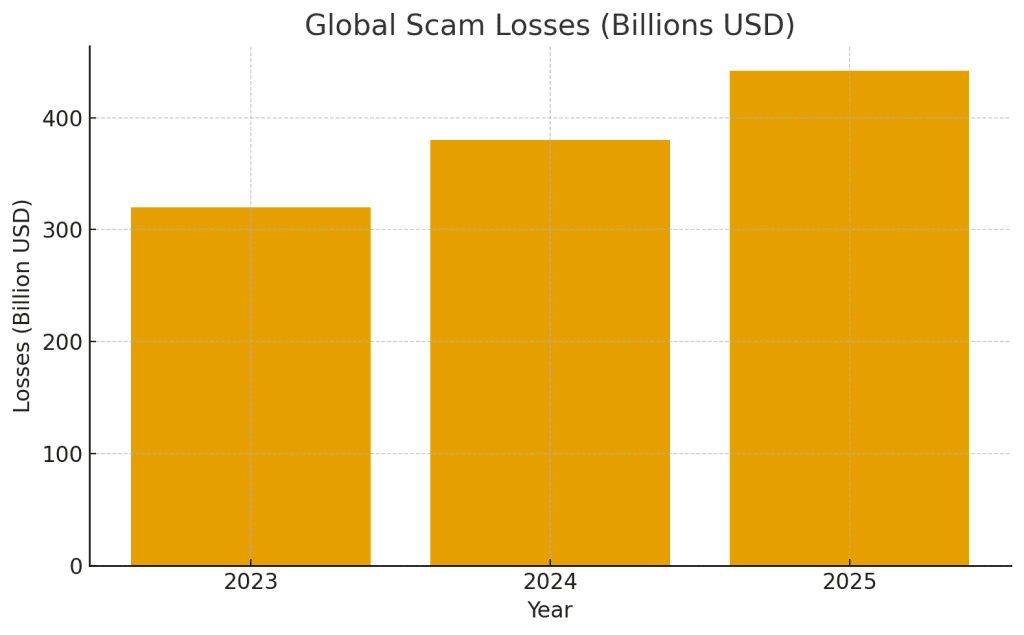

According to the Global Anti-Scam Alliance (GASA), estimated worldwide scam losses climbed to $442 billion USD, affecting more than 57% of adults. These numbers reflect a global digital ecosystem where scams are continuous, evolving, and increasingly believable.

The chart below illustrates the dramatic rise of global losses.

A Surge Fueled by AI

One of the most alarming developments in 2025 was the weaponization of generative AI by criminal groups. AI made everything more efficient: writing emails, forging documents, cloning voices, generating fake customer-support chats, even creating realistic government letters with signatures and stamps.

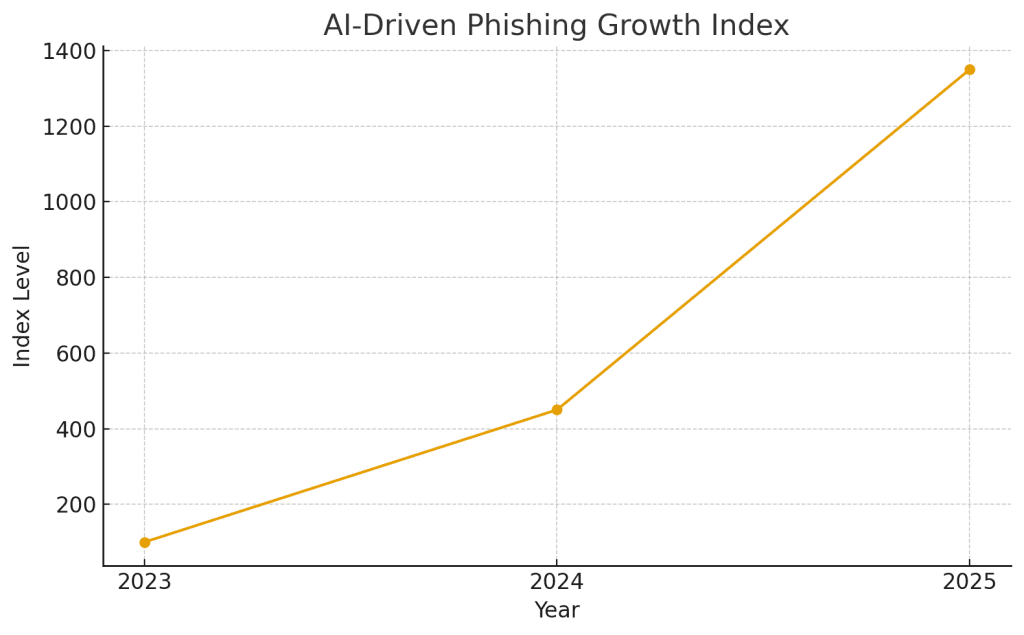

Security analysts reported that AI-driven phishing activity grew by 1,265% in just two years — an explosion mirrored in the chart below.

This shift means the classic signs people once relied on — poor grammar, mismatched fonts, awkward phrasing — can no longer be trusted. Scams now look polished. They look official. Some even mimic internal government formatting.

A few factors explain the surge:

- AI tools dramatically lowered the skill barrier for scammers

- Fraud networks began using automated “scam factories” to mass-send messages

- Voice models allowed instant impersonation of executives, family members, and bank officials

- Scammers used AI-generated websites that vanished within hours

This new generation of fraud does not just target the naïve — it targets the busy, distracted, overwhelmed, and overworked.

Regional Impact: When Local Trends Reflect a Global Crisis

The United States recorded $16.6 billion USD in losses through the FBI’s Internet Crime Complaint Center (IC3), with nearly 860,000 complaints. Canada recorded $643 million CAD in confirmed fraud losses, but officials believe the true figure could be 10× higher due to underreporting.

Europe and Southeast Asia experienced parallel trends, though reporting varies by country. Across all regions, the same pattern emerged:

Scams got faster, more automated, more personalised, and more convincing.

Who Lost the Most?

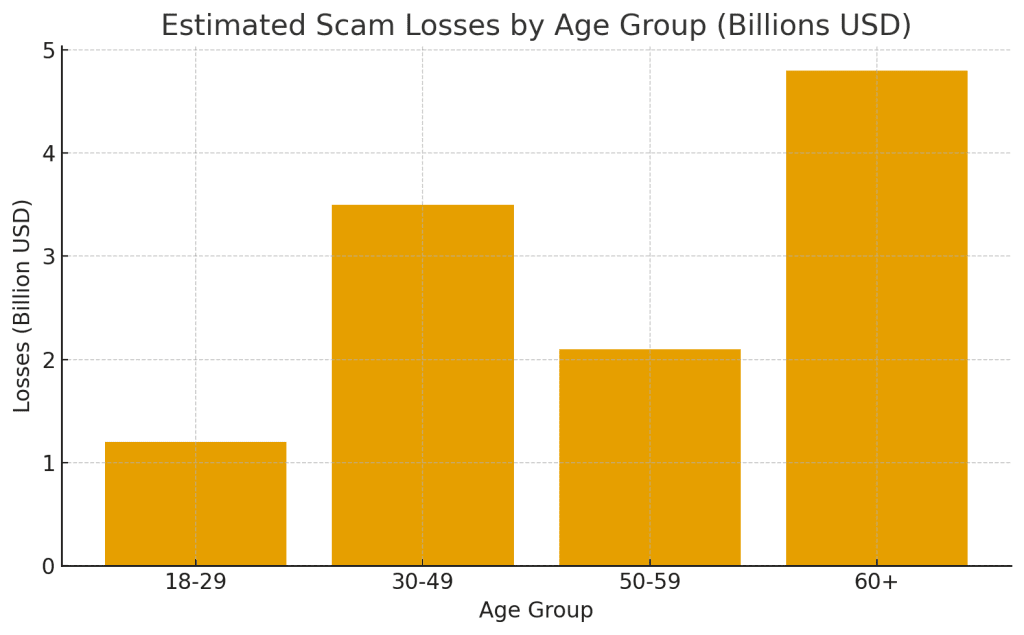

Scam losses do not fall evenly across age groups. While younger adults encounter more scam attempts due to social media exposure, older adults lose substantially more money per incident.

The chart below shows estimated global losses by age group.

Older adults (60+) remain the biggest financial victims due to:

- Long-established savings

- Higher trust in authority-style communication

- Less familiarity with AI-generated deception

But the highest number of attempted scams typically target adults between 18 and 34 — especially through Instagram, TikTok, WhatsApp, and Telegram.

How Scammers Delivered Their Attacks

Though email remains the number-one delivery channel for scams, 2025 marked a clear shift toward “multi-platform fraud.” A single scam may move across email, SMS, social media, messaging apps, and fake websites before the victim realises what’s happening.

In 2025, the most exploited channels were:

- Email: still the primary platform for phishing and impersonation

- SMS (“smishing”): widely used for delivery scams and OTP theft

- Messaging apps: WhatsApp and Telegram became dominant vectors for investment scams

- Social media: fake influencers, fake ads, and romance scams exploded

- AI voice calls: deepfake calls mimicking loved ones increased sharply

Scammers no longer rely on one trick — they use several in sequence.

The Rise of Professional Scam Networks

Another defining trend of 2025 was the industrialisation of fraud. What used to be small, individual scam operations evolved into fully structured, multinational networks resembling corporate workflows.

These operations include:

- Dedicated “script writers” using AI to generate content

- Cyber teams that maintain rotating domain names

- Voice actors supplemented by AI voice cloning

- Scam coaches training new recruits

- Payment handlers who specialise in laundering stolen money

By the time a victim realises what happened, the scammers have already dissolved the infrastructure and rebuilt it elsewhere.

Businesses Suffered Massive Losses

Fraud is no longer only a consumer problem. Corporate victims now face phishing emails that perfectly mimic internal messages, invoice fraud from spoofed suppliers, and deepfake audio impersonating CEOs.

A 2025 industry survey found:

- 79% of businesses experienced attempted payments fraud

- 63% cited Business Email Compromise (BEC) as their top threat

- The average company lost $4.88 million USD per major phishing incident

Companies are now upgrading their authentication systems, introducing multi-step approval chains, and training staff to recognise AI-crafted deception — but the gap between scam innovation and defence continues to widen.

Looking Ahead: What To Expect in 2026

If 2025 was the breakout year for AI-powered scams, 2026 will be the year these tactics become standard across fraud ecosystems. Cybercrime researchers predict:

- More AI-generated scam videos

- Deepfake customer service representatives

- Fake legal threats using cloned voices of lawyers

- Automated scam chatbots using personal data

- AI-generated online stores that vanish within days

- Even more impersonation of government and financial agencies

The data is clear: scams are not slowing down. They are scaling.

What This Means for Everyday People

The 2025 statistics tell a simple story: scammers are evolving faster than the average consumer can adapt. But they also show that awareness remains the strongest protection.

Key takeaways include:

- Don’t trust “official-looking” documents by appearance alone

- Never act on urgency — it is the scammer’s most powerful tool

- Always verify through a known channel, not the one provided in the message

- Be skeptical of all unexpected emails, calls, or texts requesting money or personal information

If you understand how scams evolve, you can stay ahead of them.